My blog has been much neglected in 2019. Here’s to hoping I have more time to devote to it in 2020.

—

Early on this year, I did a forecast for a financial institution on certain economic elements of 2019. Here is a snippet:

It being November 2019, I thought I would check in on how I was doing as far as my forecast was concerned.

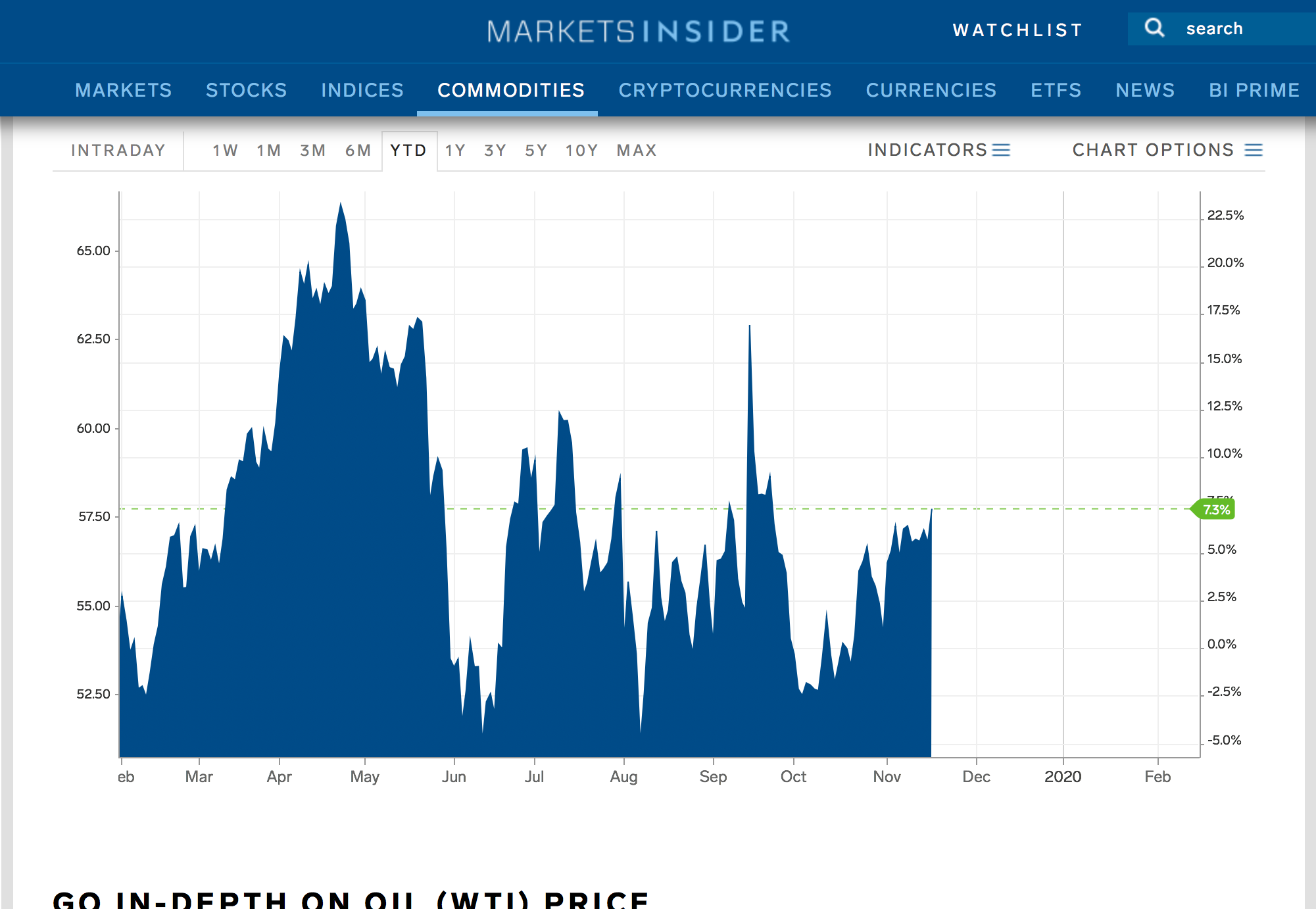

WTI Oil 2019 (dynamic chart here)

Numbers To Date:

In Feb 2019, oil was at 54.56. On Nov 2019, oil is at 56.77.

Oil’s peak price in 2019 was 23 April, 2019 at 66.30, and the 16th of September, 2019 at 62.90. Oil’s lowest point was on 12th June, 2019 at 51.14.

Evaluating the Forecast:

” Pricing indicators: small rally in May that peaks in June, before pulling back gradually in July. Spike in August and September on geopolitical pressure/tensions, before pulling back in October. However, as overall year is unfavourable, don’t expect to see a substantial shift in oil prices. Estimate no more than 10 dollars difference.”

The maximum price of oil in 2019 (to date since we still have 2 more months to go) was 66.30 and its start of the year price was 54.56. Not quite 10 dollars but I’ll take the 12 dollars as good enough. The difference between the highest and lowest price to date is 66.30 vs 51.14 – not quite 10 dollars again but 15 dollars I will argue is “good enough”.

On the numbers, the projected rally in May that peaks in June did not appear to materialise. However (using the dynamic chart above and operating on a month-to-month basis rather than looking at specific highs and lows), we can see that:

- 3 May 2019, the price of oil was 61.34. There was a rally that pushed it to 63.10 (small, I suppose). This was followed by a massive plunge in June 2019 to 51.68. On 27 June 2019, the price then shot to 59.43 (8 dollar increase). Accordingly, I missed the ‘drop’…but the rally did take place if you want to argue it that way.

- In August and September 2019, there were some spikes. Oil was at 51.09 on on 7 August 2019. It would spike 5 times across August and September 2019 but of course, within the 10 dollar bracket at all times. There were small peaks in October but generally not much volatility or movement.

The Bazi Math

Full disclaimer. I’m not about to give up the day job and become an oil trader. Nor would I suggest anyone use what I’m about to explain here to make decisions about oil prices unless you’re an enthusiastic dabbler in your own forecasts like me. (more on that maybe in the next post)

Oil prices are one of the easiest economic factors to forecast in a given year because the industry has a very clear element associated with it: namely Fire. So, forecasting the performance of oil in a given year is just about the Metal Frame (巳酉丑)and Metal element.

Simplistically, strong Metal suggests oil will do well/be profitable.

Weak Metal suggests oil won’t be profitable/will have poor earnings. (one should note though that in recent disclosures with regards Saudi Aramco’s upcoming IPO, it’s one of the most profitable companies in the world – so, the industry and climate not withstanding, there will still be companies that do well)

Similarly, figuring out the peaks and troughs for the year involves simply looking at the Jia Zi for the month (with the year as the backdrop). During strong Fire months, you would expect the price of oil to decline or fizzle or remain the same, especially in a non-supportive year. During strong Metal months, you would expect a rally (extent being dictated by whether or not the element of Metal is supported in the year).

In 2019, the primary months with metal were:

- May 2019 己巳 (Metal in Growth but in a weak Metal year)

- June 2019 庚午 (weak Metal technically)

- July 2019 辛未 (weak Metal again although with strong Water hence no projection of Rally)

- August 2019 壬申 (strong Metal with strong Water suggesting high volatility/trading activity)

- September 2019 癸酉 (strong Metal as it is the peak of Metal’s season – note, attack on Saudi oil fields was in this month, but there was no lasting reaction)

- October 2019 甲戌 (metal enters graveyard, fizzle in any rally would be expected)

The backdrop of all this of course is still the year wherein Wood is strong and Metal is weak. Wood is the Resource of Fire, so Resource is strong, suggesting optimism or even some measure of stability hence the lack of price volatility despite strong Water in the year.

0 Comments