Addendum:

One month after I published this post, articles began appearing on Tim Cook’s pay drop.

- https://www.thewrap.com/apple-ceo-tim-cooks-pay-dropped-26-percent-in-2019/

- https://www.cnbc.com/2020/01/03/apple-ceo-tim-cook-2019-compensation-dropped-from-2018.html

- https://www.bloomberg.com/news/articles/2020-01-03/apple-ceo-cook-made-125-million-in-company-s-2019-fiscal-year

Reports say his actual base pay dropped because Apple did not meet its targets per Bloomberg: ” In that 2018 fiscal year, he got a $12 million bonus, his largest ever. The bonus shrank in the latest period because Apple didn’t beat its sales and operating income targets by as much as the year before.” In fact, according to a chart on Bloomberg, 2018 was Cook’s best year. However, stock options that he had been given vested in 2019, which ostensibly increased his pay to the 125m number (however given that it is a Rob Wealth year and without knowing the vagaries of American taxation, it’s debatable if that constitutes wealth because Cook may end up paying taxes on the stocks that vest).

So…I officially rescore myself on this forecast! I got…some of it right!

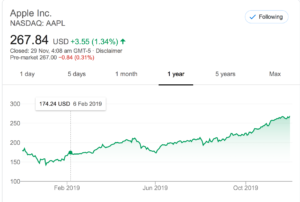

One of the forecasts I made for 2019 was that Apple’s stock could go down and so anyone keen to take a punt in 2019 would basically bet against Apple or short the stock. I of course wasn’t alone. Apple is one of the top 5 shorted stocks of 2019.

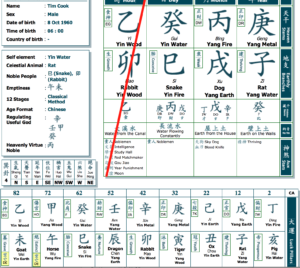

My reason for suggesting a short on Apple was simply by looking at Tim Cook, CEO of Apple’s chart. Mr Cook is a Gui Water, born in Dog – simplistically this is a strong Day Master. He’s in his 52-62 10 year Luck pillar which is a strong Rob Wealth Luck pillar. And 2019 is the year of Pig, which is the Rob Wealth of Gui Water. So clearly, in 2019, 2020 and possibly 2021, Tim Cook is going through a Rob Wealth Luck Pillar and Rob Wealth years. For all intents and purposes, Tim Cook should be losing money (personally), and given how much renumeration of Wall Street CEOs is centred around stock options, it would make sense to assume that Apple would accordingly see its price tank.

However, if anyone has seen the graph for Apple’s stock this year, it looks like this:

As of today, Apple’s stock is at 267.79, which is a 93.55 appreciation.

So, the BaZi consultant thinks – wtf. How did I get this wrong?

And then…

Apple quietly bought $17B more after record high $24B Q2 stock repurchase

So if you’re not familiar with stock buy backs conceptually, it is one of the ways in which companies can maintain or increase their share price by effectively reducing the amount of public float available. Or as Investopia puts it: “A share repurchase is a transaction whereby a company buys back its own shares from the marketplace. A company might buy back its shares because management considers them undervalued. The company buys shares directly from the market or offers its shareholders the option of tendering their shares directly to the company at a fixed price. A share buyback reduces the number of outstanding shares, which increases both the demand for the shares and the price.”

The question is however how long that Apple can keep doing it for because whilst it has a formidable cash pile, if I was a betting person in the vein of some crazy hedge fund dude like someone in Billions, I’d keep the bet up. Cause WINTER HAS TO BE COMING.

But yes, no disco here.